stanislaus county tax collector property tax

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Tax Collector Website Disclaimer.

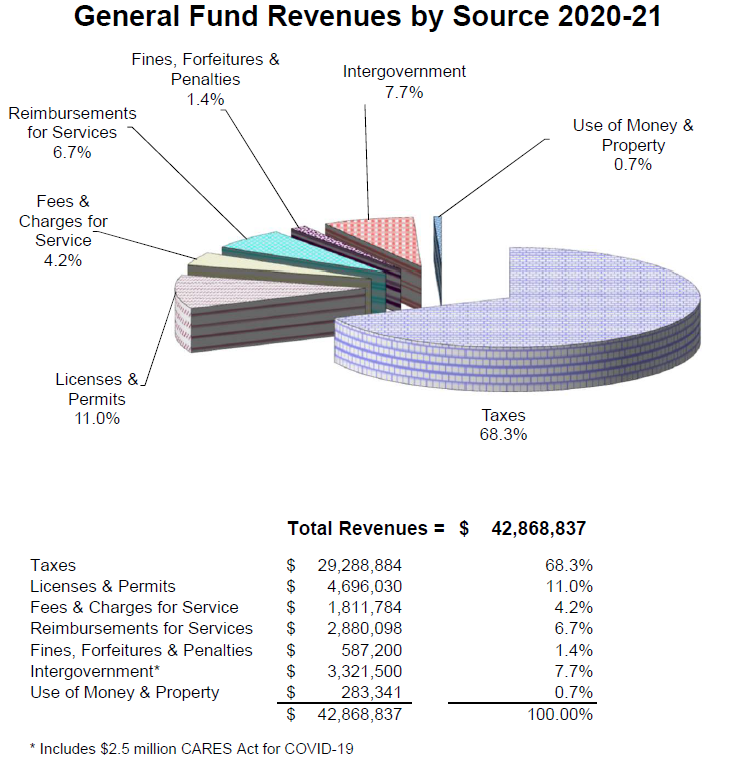

It is the role of the County Auditor-Controllers Property Tax Division to place these tax amounts on the parcels tax bill and in turn distribute the tax revenue collected to the proper agency.

. Free Stanislaus County Land Records Search Find. Property Taxes Search andor Pay Property Tax On-line To start a search choose the Property Tax button on the left. Property Tax 1010 10th Street Suite 2500 Modesto CA 95354 Phone.

When contacting Stanislaus County about your property taxes make sure that you are contacting the correct office. The Tax System is available for credit card and debit card payments. Reach us 24-hours a day.

For More Information Current Air Quality. The median property tax in Stanislaus County California is 1874 per year for a home worth the median value of 285200. Our website is an ongoing part of my commitment to keeping you informed.

Give us your questions comments or feedback. Property Tax 1010 10th Street Suite 2500 Modesto CA 95354 Phone. Stanislaus County Regional Transit.

1877 2-ASSIST 1877 227-7478. Closed Weekends Holidays. Treasurer Tax Collector.

TIMKO LORRAINE ET AL. Stanislaus County collects on average 066 of a propertys. You can call the Stanislaus County Tax Assessors Office for assistance at.

Treasurer Tax Collector Forms. Perform a free Stanislaus County CA public land records search including land deeds registries values ownership liens titles and landroll. Treasurer Tax Collector.

Call 530-842-8123 for burn day status or toll-free within Siskiyou County 866-652-2876. 4843 ADAMS AVE SALIDA. Census Bureau American Community Survey 2006.

As the elected Assessor of Stanislaus County it is my sworn responsibility to uphold the States Property Tax Laws. It takes three County. View or Pay Property Taxes Requires parcel number which can be found on your Tax bill Agency Login - Inquiry.

For Environmental Issues Only. I certify under penalty of perjury that the foregoing is true and correct. The Tax Collector is responsible for the billing and collection of secured unsecured supplemental transient occupancy tax as well as various other special assessments for the.

Public Health Hsa Stanislaus County

Stanislaus County Is Red Faced Over Message On Tax Letters Modesto Bee

Stanislaus Resort Developer Has Not Paid Millions In Taxes Modesto Bee

Assessor S Office Stanislaus County

Property Tax By County Property Tax Calculator Rethority

Assessor S Office Stanislaus County

Property Taxes And Assessments Division Auditor Controller Stanislaus County

Garry Browning Cpa On Linkedin Don T Forget Your Property Tax It Is Still Due April 10th

Assessor S Office Stanislaus County

1997 98 Budget Analysis Property Taxes Why Some Local Governments Get More Than Others

Contacts Treasurer Tax Collector Stanislaus County

Understanding California S Property Taxes

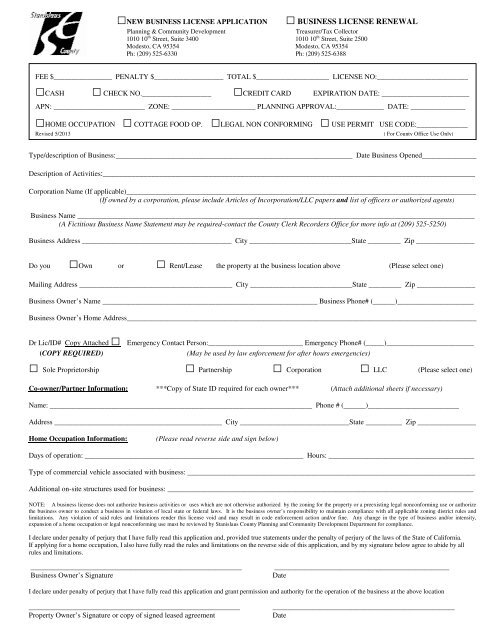

Business License Application Stanislaus County

Property Tax Postponement Program Offered Ceres Courier

Contacts Treasurer Tax Collector Stanislaus County

Faq S Assessor S Office Stanislaus County

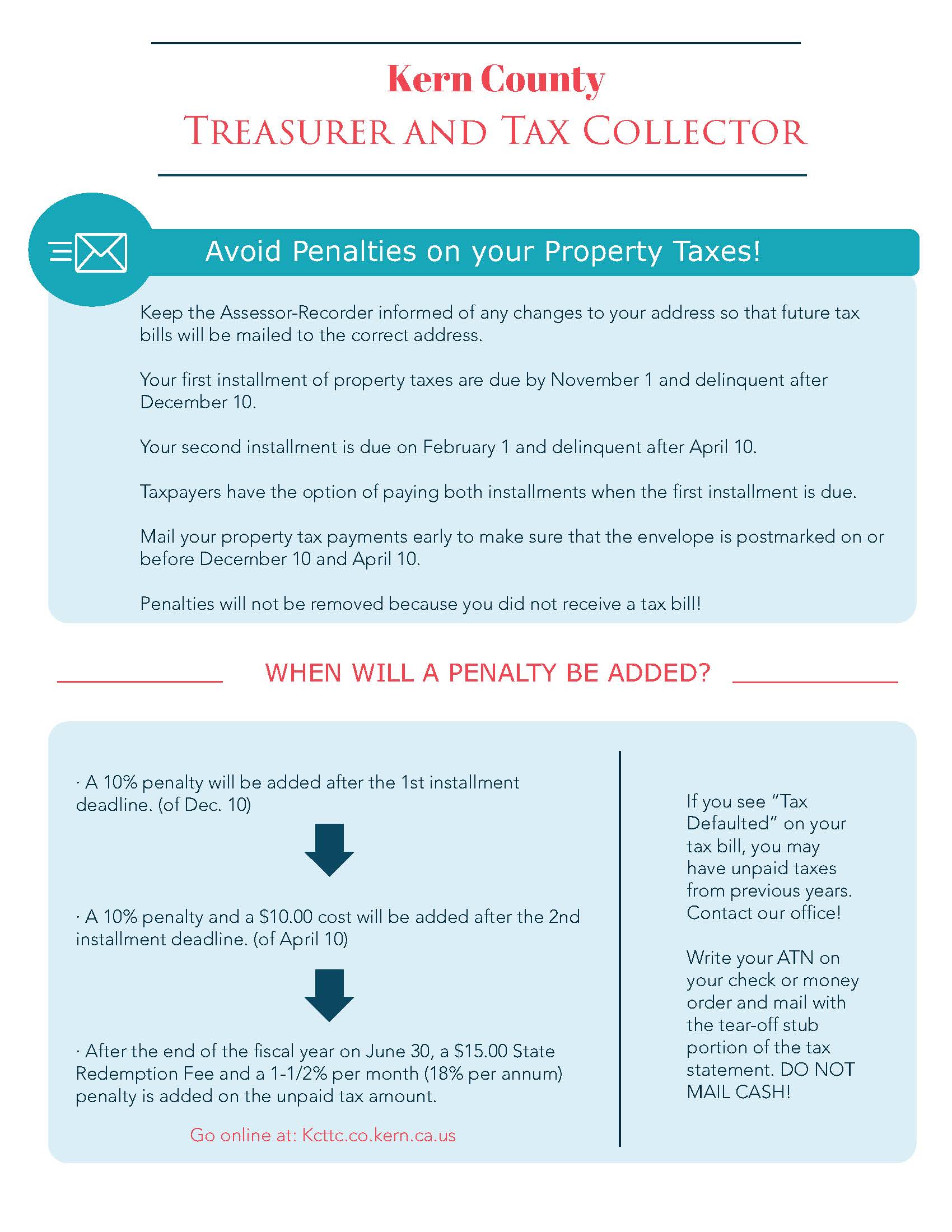

Kern County Treasurer And Tax Collector

Property Tax Division Treasurer Tax Collector Stanislaus County